March 25, 2024: Let’s Pop a Top and Talk About Real Estate – Fed and Mortgage Rates

There was a Fed meeting last week where Chairman Jerome Powell spoke about the current conditions of our economy and how that would impact the Fed and mortgage rates. He seemed very optimistic saying that we will see increased GDP growth and we will see rate cuts later on this year.

That seems a little strange to me, that we would expect to see an increased growth and rate cuts happening at the same time in order to fight inflation. I would think we wouldn’t want all of those things to happen all at once – but, you know, I am not a national economist.

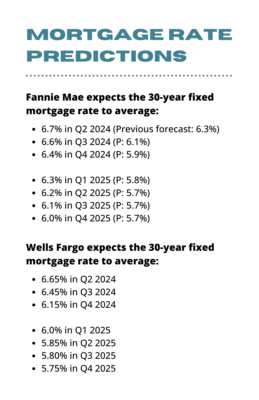

Most likely in June, we will see a small rate cut, more like a quarter or half a percent, in the Fed fund rate. However, that does not mean that mortgage rates will fall the same amount. We are projected that interest rates will be around 6.5% – 6.25% by the end of the year. See below for the mortgage rate predictions through 2025.

Through all of this, how you structure your offer is more important than ever! If you are a buyer, you can work it in your offer to have the sellers help contribute to buy down your rate – we’ve seen them get down to around 5%.

If you are interested in learning more, reach out to me at 509-508-0461 or at chase@baxterhometeam.com